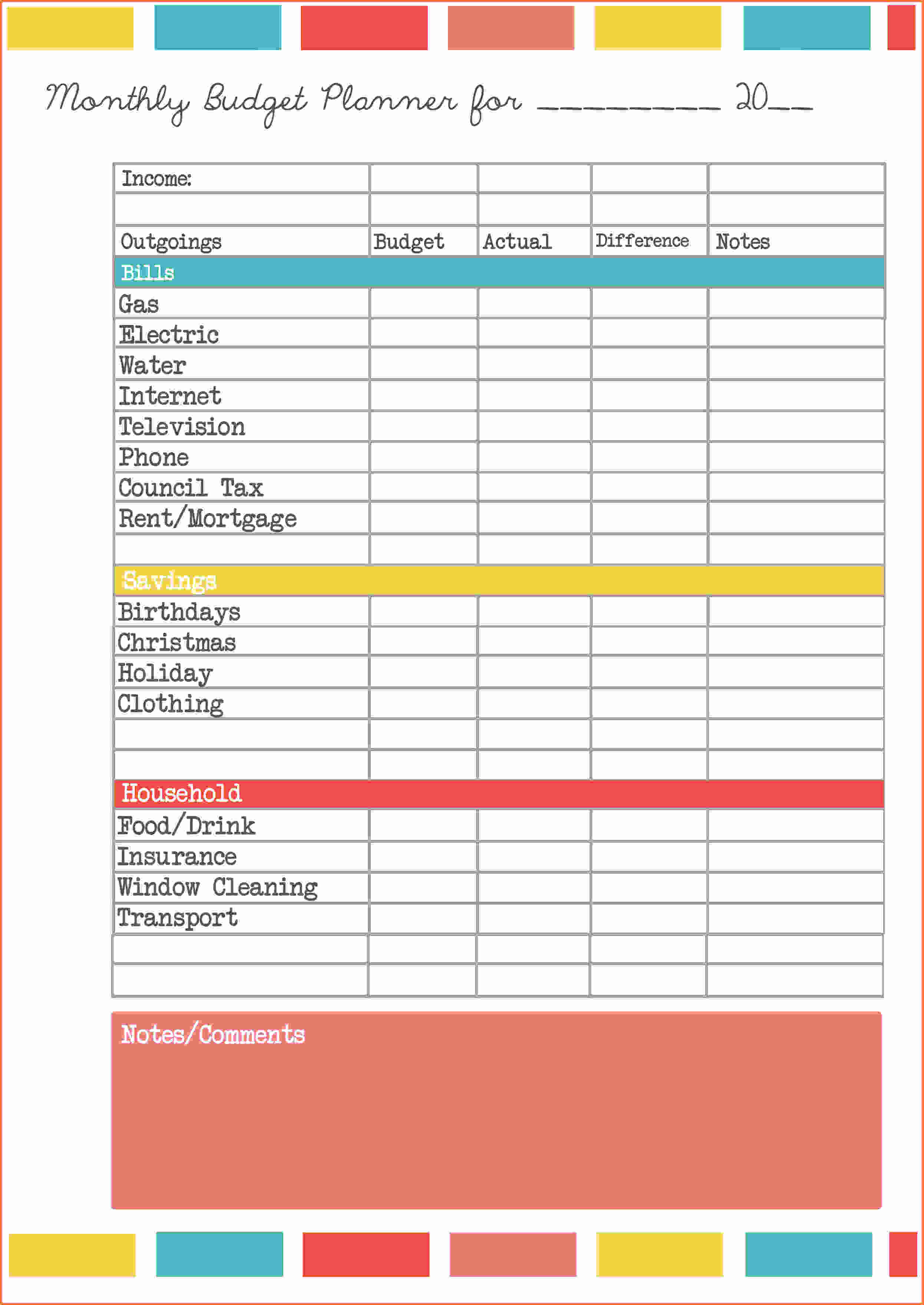

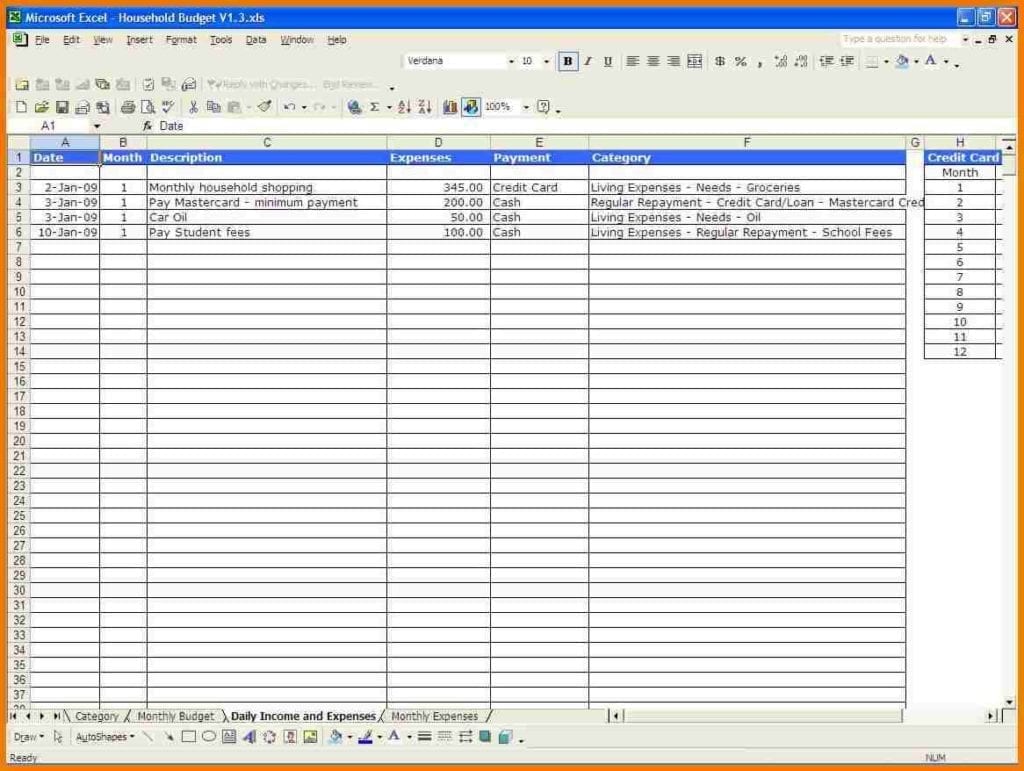

Here are some tips to accurately gather your existing expenses to document in your budget: Instead of trying to track these mini variable expenses, you might be better off stating ‘I have $50 per week for variable expenses’ and work towards sticking to this number. For instance, some days you may buy a coffee – other days you may not.

You estimate you spend $1,500 per month.

When calculating your expenses, also factor in unexpected bills, such as unplanned car repairs.Ī good rule of thumb is to add an extra 10 per cent to 15 per cent. A forgotten bill really throws a wrench into your savings plan. Remember that being thorough when you add up expenses is important in creating a realistic budget. Some expenses are intermittent, such as insurance payments, so to get the most accurate financial picture you can calculate an average for six months to a year. Assess your expenses by consulting your bank statements, receipts, and financial files.

0 kommentar(er)

0 kommentar(er)